by Tracy Ruby Team | Oct 7, 2024 | Home Loans, Homebuyers

Buying a home is one of life’s biggest milestones—a place to make lasting memories, build your future, and truly create a place to call your own. But let’s face it: the homebuying process can feel a bit overwhelming at first. But with the right preparation and...

by Tracy Ruby Team | Oct 7, 2024 | Home Loans, Homebuyers

Don’t let these condo loan myths get in your way of homeownership! Condominiums can be an appealing alternative to traditional homes, offering perks like lower maintenance, community features, and prime locations. However, some potential homebuyers may hesitate to...

by Tracy Ruby Team | Oct 1, 2024 | Conventional, Home Loans, Homebuyers

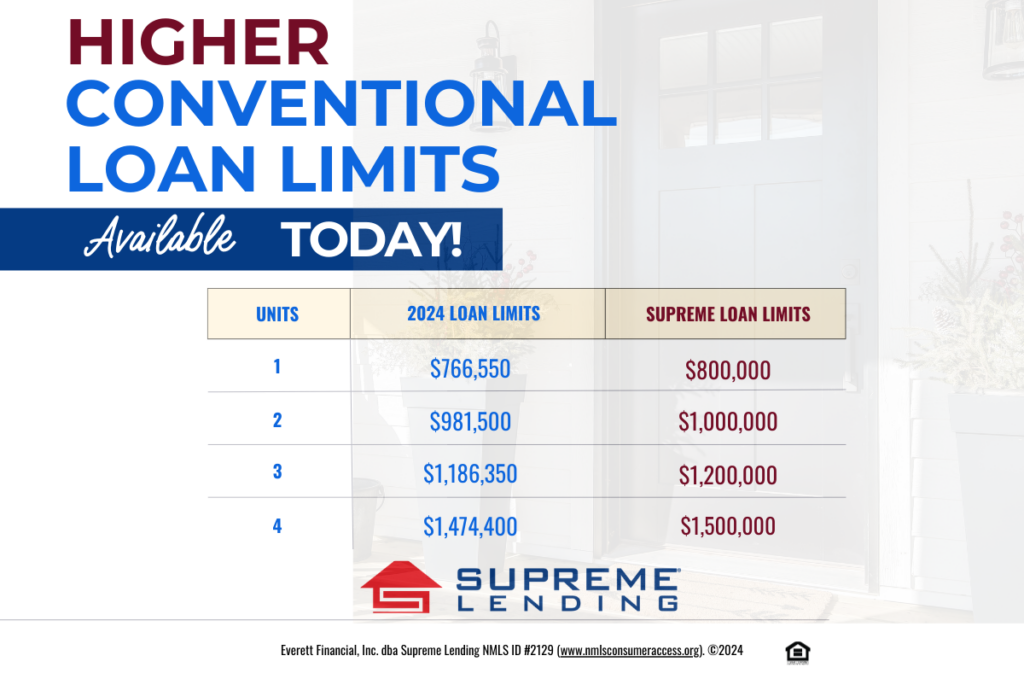

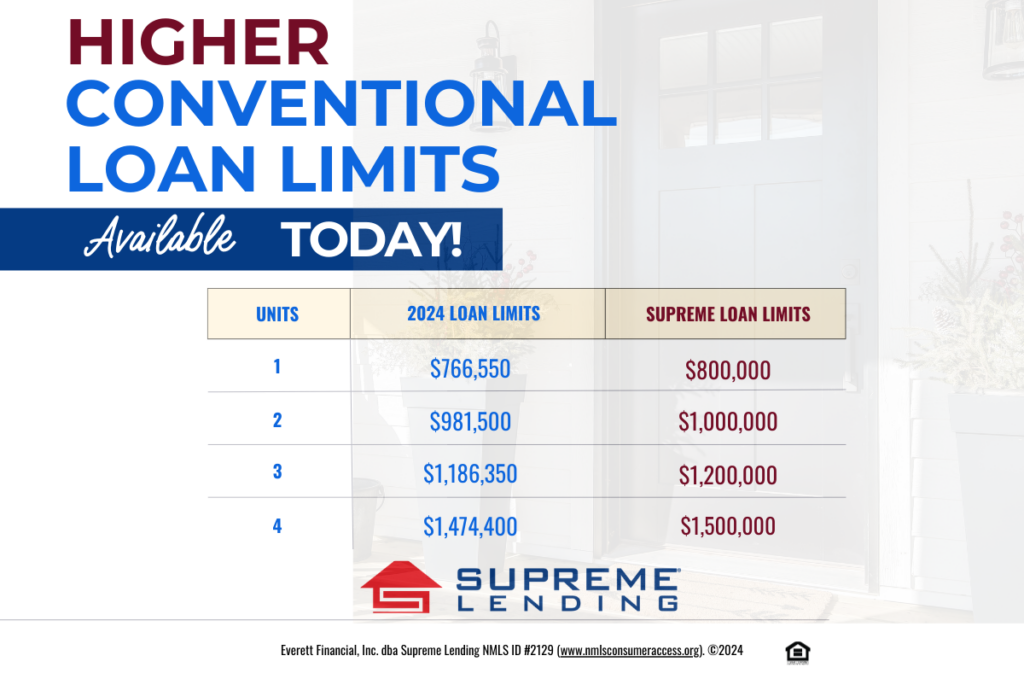

Supreme Lending is proud to announce the conforming 2025 loan limits have increased and, the best part, the company is offering the raised loan limits today. For single unit properties, the conforming limit is now $800,000, up from $766,550. While Fannie Mae and...

by Tracy Ruby Team | Sep 20, 2024 | FHA, Home Loans

Can repeat buyers qualify for FHA loans? When you think of an FHA loan, it’s often associated with first-time homebuyers. After all, FHA loans are widely known for lower down payment and flexible credit requirements. But did you know that FHA loans are not just...

by Tracy Ruby Team | Sep 12, 2024 | Home Loans, Homebuyers, Homeowners

Your Quick Home Appraisal Checklist When buying or selling a home, it’s important to understand the importance of a home appraisal during the mortgage process. Appraisals determine the value of a property based on various factors, ensuring buyers, sellers, and lenders...

by Tracy Ruby Team | Aug 20, 2024 | Home Loans, Refinance

When homeowners think about tapping into the equity they’ve built in their property, a Home Equity Line of Credit, also known as a HELOC, may come to mind. This alterative transaction mortgage can be incredibly versatile and useful for eligible homeowners to access...