by Tracy Ruby Team | Oct 7, 2024 | Home Loans, Homebuyers

Buying a home is one of life’s biggest milestones—a place to make lasting memories, build your future, and truly create a place to call your own. But let’s face it: the homebuying process can feel a bit overwhelming at first. But with the right preparation and...

by Tracy Ruby Team | Oct 7, 2024 | Home Loans, Homebuyers

Don’t let these condo loan myths get in your way of homeownership! Condominiums can be an appealing alternative to traditional homes, offering perks like lower maintenance, community features, and prime locations. However, some potential homebuyers may hesitate to...

by Tracy Ruby Team | Oct 2, 2024 | Homebuyers, Homeowners

Deciding between renting vs. owning a home may be one of the biggest debates when it comes to housing. Both options offer unique advantages, but the key is to find which fits your personal goals and lifestyle. Let’s explore the pros and cons of each option and take a...

by Tracy Ruby Team | Oct 1, 2024 | Conventional, Home Loans, Homebuyers

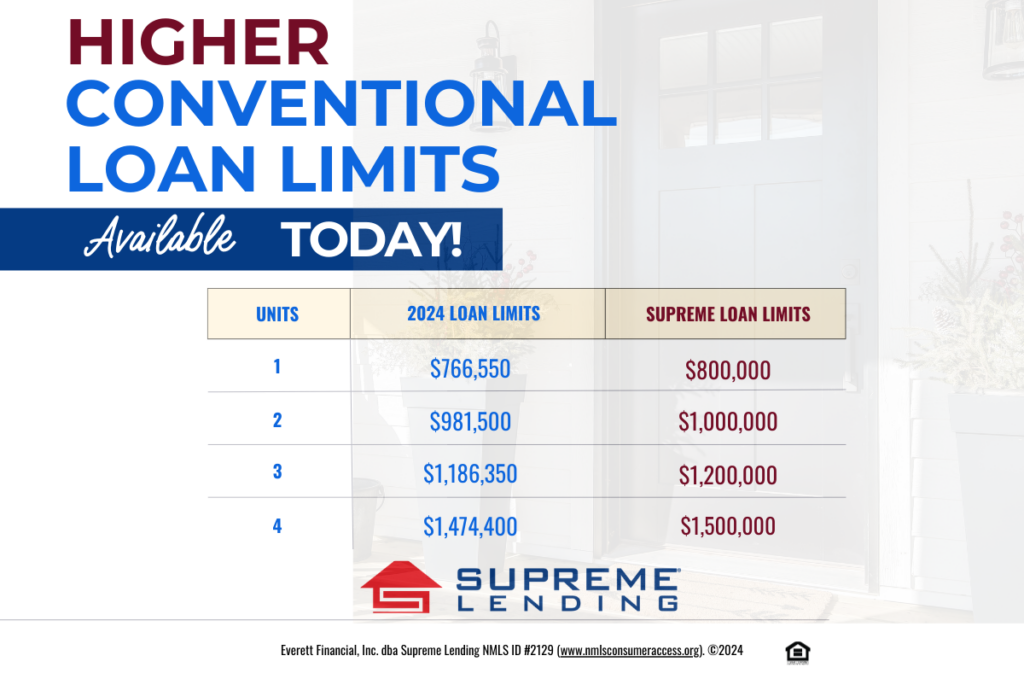

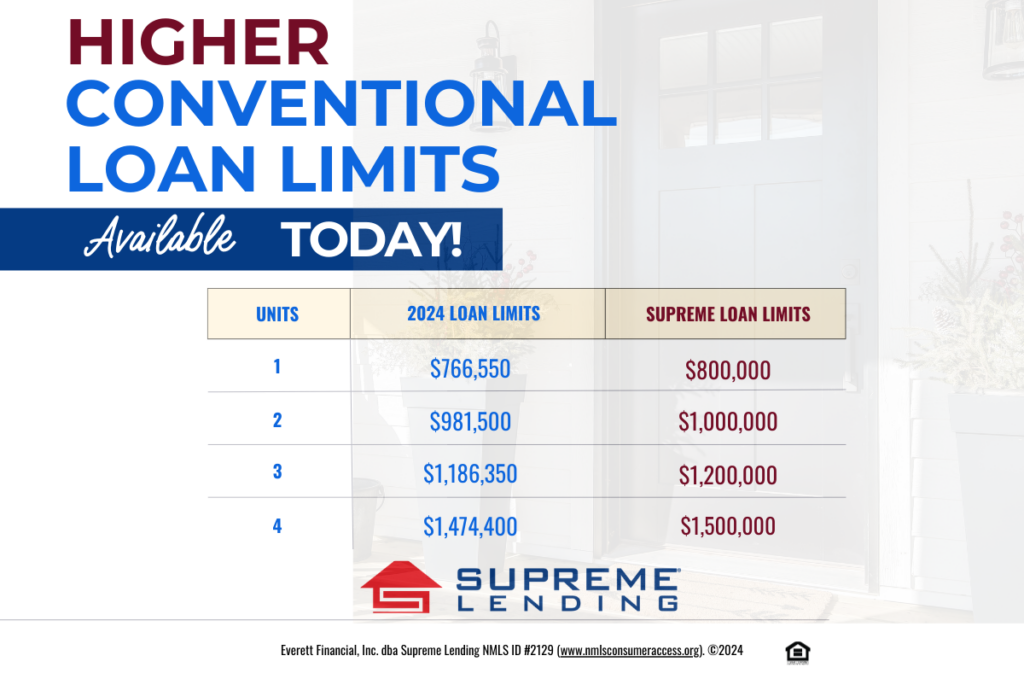

Supreme Lending is proud to announce the conforming 2025 loan limits have increased and, the best part, the company is offering the raised loan limits today. For single unit properties, the conforming limit is now $800,000, up from $766,550. While Fannie Mae and...

by Tracy Ruby Team | Sep 30, 2024 | Homebuyers, Homeowners

Buying a home is a major milestone, and while most prospective buyers are focused on saving for the down payment, there are additional homebuying costs to consider. From closing costs to ongoing home maintenance expenses, it’s important to understand the costs beyond...

by Tracy Ruby Team | Sep 12, 2024 | Home Loans, Homebuyers, Homeowners

Your Quick Home Appraisal Checklist When buying or selling a home, it’s important to understand the importance of a home appraisal during the mortgage process. Appraisals determine the value of a property based on various factors, ensuring buyers, sellers, and lenders...